Essential English for Accounting Terms and Courses [With Quiz]

If you’re an accountant or bookkeeper, or planning to become one soon, you’re going to need some English for accounting.

With this lesson in accounting terms, you’ll expand your business English vocabulary and boost your confidence in working with English speakers. After learning the terms, you can take a quiz to test your knowledge.

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

Financial Statements and Reporting

1. Assets

Everything a company owns, including cash, accounts receivable (money a company is going to receive, see below), property and goods.

2. Liabilities

Everything that a company owes to others, like loans and mortgages.

3. Balance Sheet

A document that records a company’s assets and liabilities at a certain moment in time. If we’re talking about a public company, it also shows the shareholders’ equity (how much the shareholders own). See #30 for the definition of “shareholder.”

The balance sheet is based on the accounting equation:

assets = liabilities + owner’s equity

The balance sheet is important for potential investors because they can see how the company is doing.

4. Cash Flow

Money coming in (inflows) and going out (outflows) of a company.

They had a cash flow problem due to their very high financing costs.

5. Financial Statements

Documents that show the financial situation of a company. They include the balance sheet (showing assets, liabilities and shareholders’ equity), the income statement (showing revenues and expenses) and statement of cash flows (showing cash flow fluctuations in a certain accounting period).

6. Accounting Period

The time period over which financial statements are produced, usually a year.

7. Income Tax

Money that individuals and companies owe to the government, based on the income they make.

She was a sole proprietor and she hired an accountant to file her income tax return every year.

8. Value Added Tax (VAT)

A tax that consumers pay on most products and services, except most food and drugs. Not all countries have a VAT system. In the US, most states have something similar, called a sales tax.

The bookkeeper had to calculate the Value Added Tax in order to issue the invoice.

9. Return on Investment (ROI)

The profitability ratio of a certain investment. The return on investment is calculated as the benefit gained from the investment divided by the cost of the investment.

Accounts and Transactions

10. Debit

An entry that shows what a company spends. Debits are recorded on the left side of an account.

She recorded the purchase of the new laptops as a debit entry.

11. Credit

An entry that shows how much money a company receives. Credits are recorded on the right side of accounts.

12. Payroll

A list of all a company’s employees and their salaries. Payroll also refers to the total amount of money paid by a company to its employees.

13. Double Entry

An accounting system in which each transaction is recorded as both a credit and a debit, an asset and a liability.

14. Accounts Receivable

Money a company is owed for goods or services it has sold. For example, if a customer buys something from you and promises to pay you next month, that’s an account receivable.

15. Accounts Payable

Money a company owes for goods and services. If your company buys something but doesn’t pay immediately, it has an account payable.

Once they pay all their accounts payable, they’ll be able to invest in new equipment.

16. Audit

A formal inspection of a company’s accounts. Companies are sometimes audited to make sure that they are following the correct accounting procedures.

The company had an external firm come in to do the audit and make sure their accounts were in order.

17. Bookkeeping

The activity or occupation of keeping records of the financial affairs of a company.

18. Gross

An amount of money before taxes are deducted. This is also an adjective and is therefore used before a noun such as “income.”

19. Profit

The money a business is left with after deducting all the expenses.

20. Revenue

The total amount of money a company receives from the services or products it sells. The revenue is higher than the profit because the profit is the revenue minus the expenses.

Our company has experienced a decrease in revenue due to the financial crisis.

21. Appreciation

The increase in the value of a company’s assets. Appreciation can be the result of an increase in demand for a product or service. The verb form is “to appreciate.”

22. Depreciation

The decrease in the value of products or services a company offers. Depreciation can be due to a high supply of similar products or services offered by competitors. The verb form is “to depreciate.”

23. Overhead

All the expenses a company needs to pay for, like the costs of advertising, labor, bills and taxes.

24. Owner’s Equity

A part of a company’s assets that the owner has. It’s calculated as assets minus liabilities.

Roles and Practices in Accounting

25. Auditor

A person whose job is to evaluate accounting records in order to make sure they have been done properly and to check if the company is being run efficiently.

26. Bookkeeper

A person whose job is to record daily transactions, issue invoices and complete payrolls. Bookkeepers are usually supervised by accountants. Bookkeepers don’t need a degree in accounting and can have less experience than accountants.

27. Chartered Accountant

An accountant who has a certain amount of experience and who has passed certain exams that qualify them to be a member of an institution, such as the Institute of Chartered Accountants in the UK. In the US a similar title is that of Certified Public Accountant (CPA).

28. Creative Accounting

An accounting practice that tries to present an improved image of a company’s financial situation by highlighting mainly the aspects that are favorable. Creative accounting is considered to be legal, but is often seen as unethical.

29. Share

A unit of ownership in a company. The person or organization who owns shares (the shareholder) is entitled to dividends (usually cash), but they also share the responsibility if there are losses.

30. Shareholder

A person or organization (company or any other institution) that owns shares in a company. Shareholders are, in a way, the owners of a company. If the company is doing well, the value of the shares goes up. If, on the contrary, the company isn’t profitable, the value of its shares decreases.

Common Phrases and Idioms

31. In the red

When a company is in “red ink,” it means they’re operating at a loss. In other words, they’re spending or owe more money than they’re earning.

Their company has made a profit before, but now they’re in the red.

32. In the black

“In the black” refers to a business’s financial status, typically its most recent accounting period. When a business is in the black, it means it’s profitable, solvent and not in debt.

We’ve been in the black ever since we launched our new product line.

33. Write off

To “write off” means to reduce the value of an asset to zero because it’s no longer recoverable or worth its original value.

The company had to write off bad debts from several clients.

34. Balance the books

“Balance the books” means to ensure that all financial records, such as debits and credits, are accurately calculated and that the total amounts are equal, indicating that the accounts are correctly managed.

You’ll have to stay late to balance the books before the end of the financial year.

35. Crunch the numbers

“Crunch the numbers” means to perform complex calculations or analyze a large amount of numerical data, often to make financial decisions.

Quiz on English Accounting Terms

Look at the following sentences and choose the correct answer to test your understanding of the terms you just learned. If you want to retake the quiz or start over, just refresh the page.

Courses on English for Accounting

To learn more English for accounting, check out one of these highly-rated courses:

- English4Accounting: This is a great resource because it offers a variety of activities to practice accounting vocabulary in context: reading exercises, multiple choice questions, listening comprehension exercises, spelling and recognition questions and teacher-graded speaking and writing activities.

- “Mastering English for Accounting: Grammar Rules and Examples”: This course on Udemy will teach you how to use various English verb tenses and grammar rules with an accounting context. It’s for intermediate English learners with previous knowledge of accounting.

- “Tax & Accounting English Masterclass”: This is another course offered on the Udemy platform. You’ll learn how to pronounce essential accounting terms, general tax terms, frequently used verbs in the accounting profession and more. It’s for students with a basic level of general English and previous knowledge of accounting and taxes.

Now that you’ve learned and practiced all these terms, the only thing left is to incorporate them into your speaking and writing!

With this new knowledge and some resources for additional learning, you’re well on your way to doing business in English with ease.

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

And One More Thing…

If you’re like me and prefer learning English on your own time, from the comfort of your smart device, I’ve got something you’ll love.

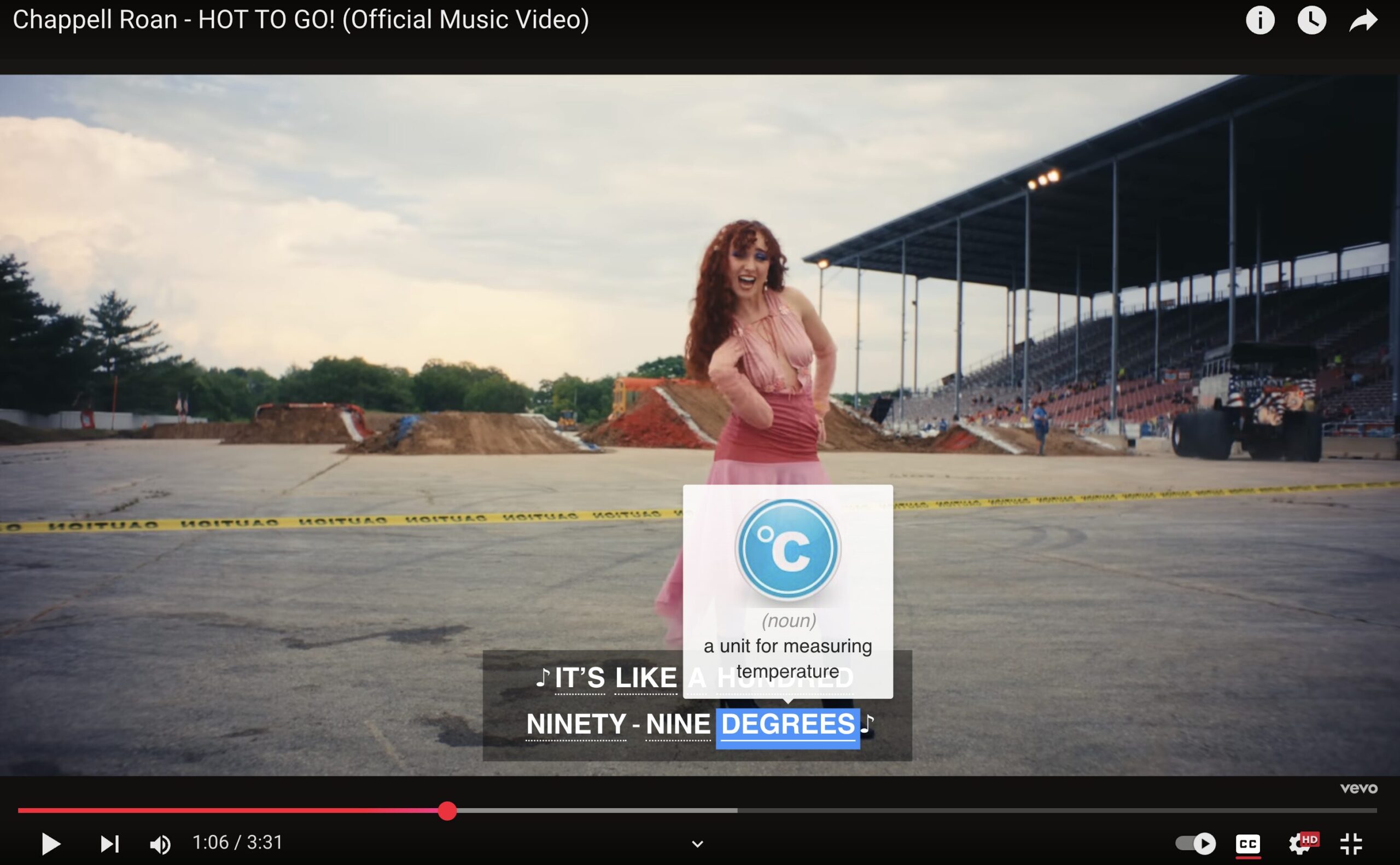

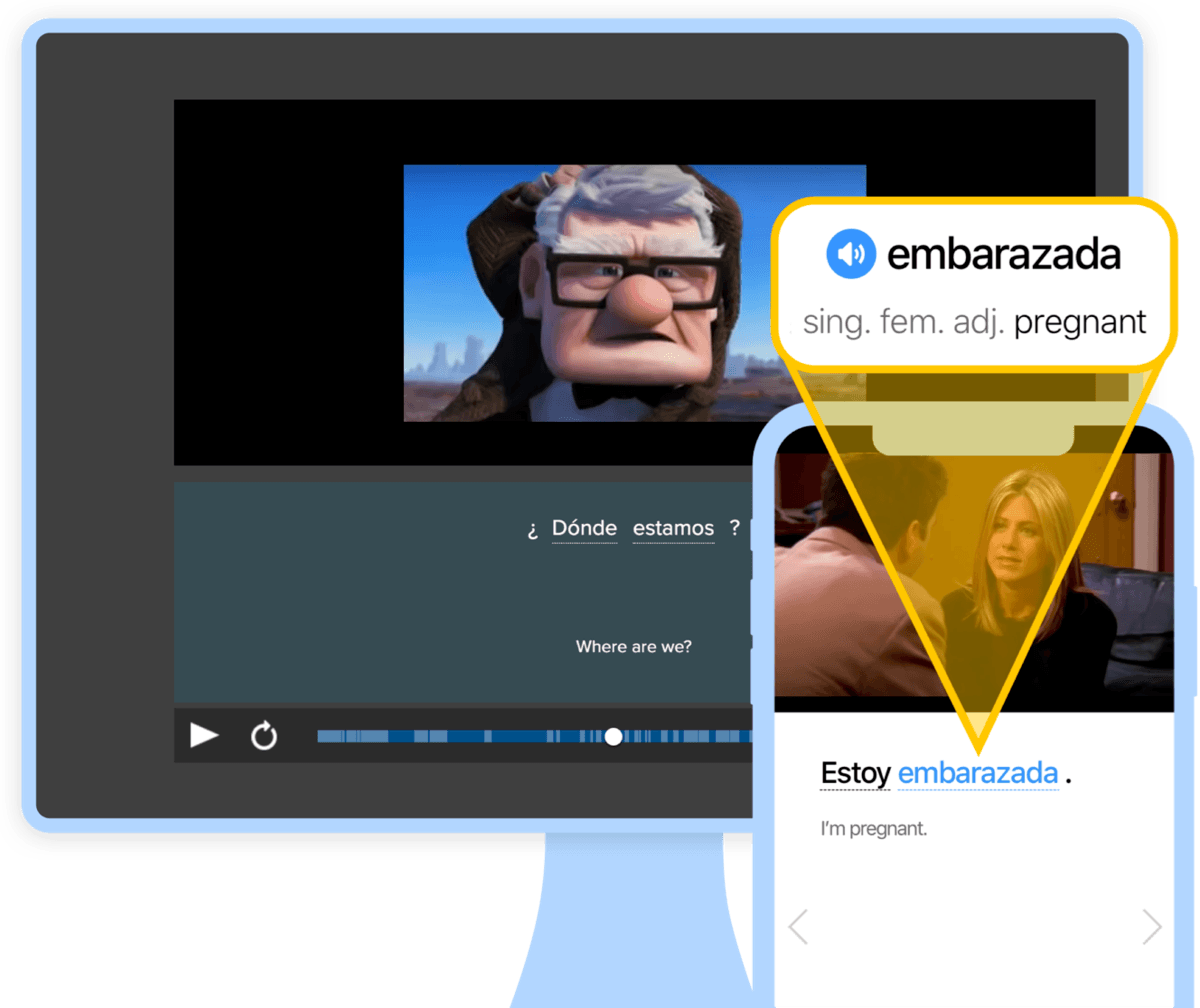

With FluentU’s Chrome Extension, you can turn any YouTube or Netflix video with subtitles into an interactive language lesson. That means you can learn from real-world content, just as native English speakers actually speak.

You can even import your favorite YouTube videos into your FluentU account. If you’re not sure where to start, check out our curated library of videos that are handpicked for beginners and intermediate learners, as you can see here:

FluentU brings native English videos within reach. With interactive captions, you can hover over any word to see an image, definition, and pronunciation.

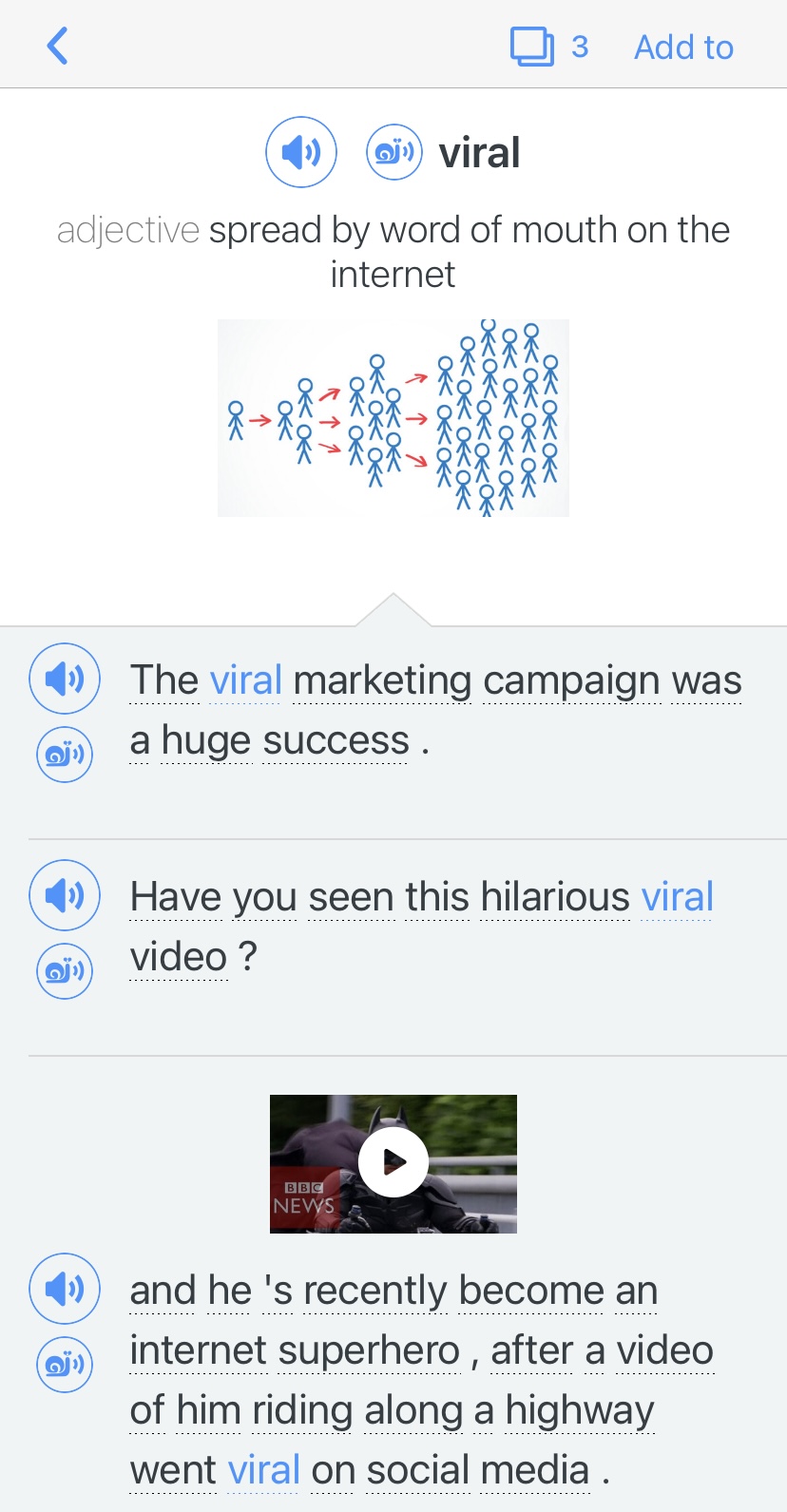

Just click on the word to see other example sentences and videos where the word is used in different contexts. Plus, you can add it to your flashcards! For example, if I tap on the word "viral," this is what pops up:

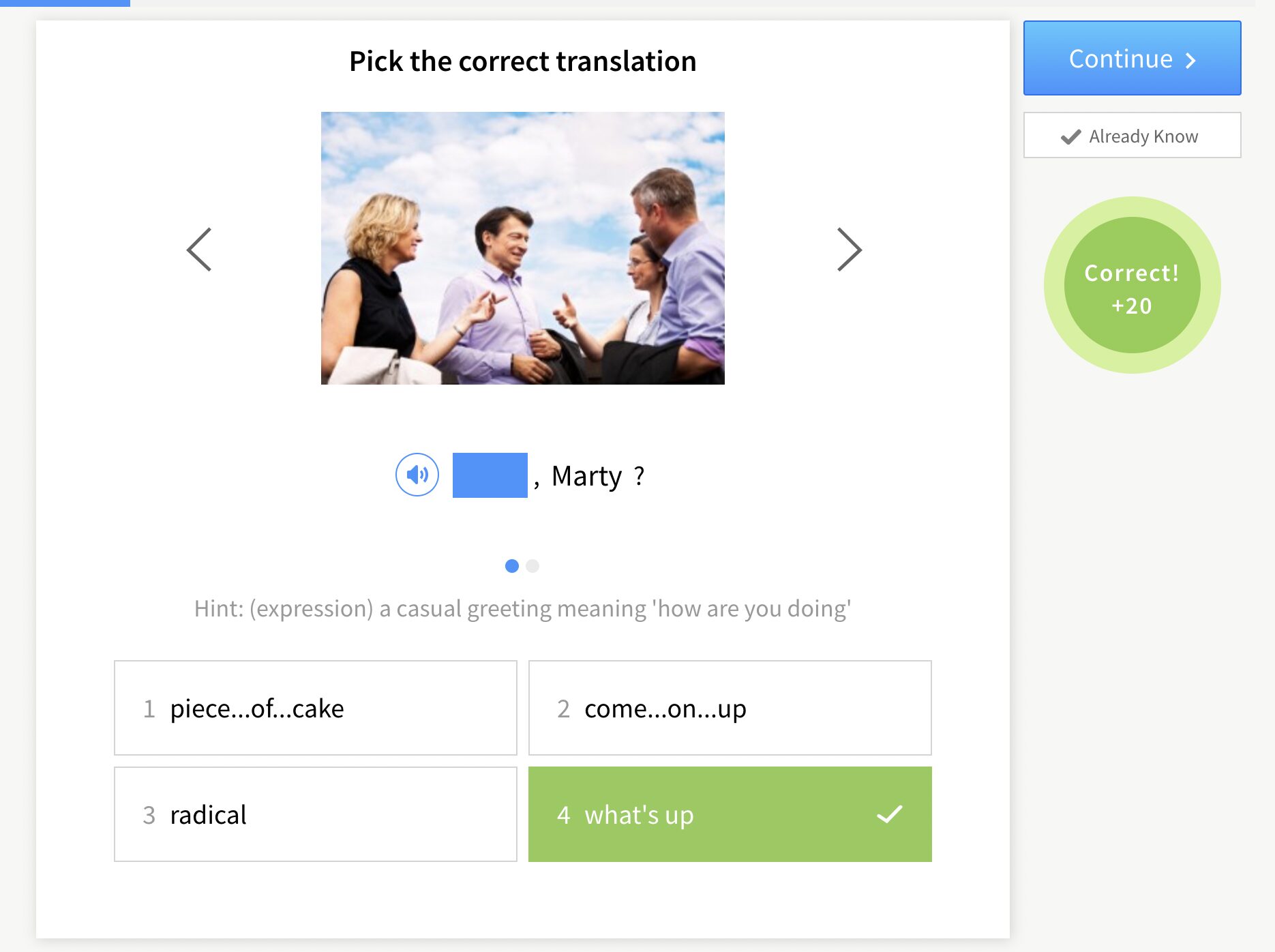

Want to make sure you really remember what you've learned? We’ve got you covered. Practice and reinforce the vocab from each video with learn mode. Swipe to see more examples of the word you’re learning, and play mini-games with our dynamic flashcards.

The best part? FluentU tracks everything you’re learning and uses that to create a personalized experience just for you. You’ll get extra practice with tricky words and even be reminded when it’s time to review—so nothing slips through the cracks.

Start using the FluentU website on your computer or tablet or, better yet, download our from the App Store or Google Play.

Click here to take advantage of our current sale! (Expires at the end of this month.)