Contents

- English Words for Economics

- 1. Accounts

- 2. Balance Sheet

- 3. Capital Gains Tax (CGT)

- 4. Deflation

- 5. Earnings Per Share (EPS)

- 6. Financial Year / Fiscal Year

- 7. Golden Rule

- 8. Half Year

- 9. Income Tax

- 10. Joint Account

- 11. Keynesian Economics

- 12. Liquid Asset

- 13. Macroeconomics and Microeconomics

- 14. Net Asset Value (NAV)

- 15. Oligopoly

- 16. Pay As You Earn (PAYE)

- 17. Quota

- 18. Real Interest Rate

- 19. Shareholder

- 20. Tax Haven

- 21. Unit Trust

- 22. Value-added Tax (VAT)

- 23. White Knight

- 24. X-Efficiency

- 25. Yield

- 26. Zombie Fund

- Resources for Improving Your Economics Vocabulary

- English Immersion from Your Device

Economics Vocabulary: An A to Z List [with Audio]

When it comes to economics, knowing the right English jargon for your job is important.

It not only highlights your technical expertise but also shows that you’re committed to your job.

It will allow you to work with clients from all over the world, or even get a job in an English-speaking country!

In this post, you’ll learn 26 essential words to know if you’re working or studying in the field of economics, or just for discussing the economy with others.

From A to Z, these terms will help you speak the language of economics and feel more confident in your daily conversations.

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

English Words for Economics

The definitions provided here have been adapted from the much longer and more complicated definitions on Wikipedia, Investopedia and online business dictionaries, to make for easier understanding. Follow the links within the definitions to discover more details about each term.

1. Accounts

Accounts are the records of all financial transactions, including expenses and receipts, of an organization or an individual.

Sheila needs to check her accounts to see if she can afford the new house.

2. Balance Sheet

A balance sheet is a statement of a company’s assets, liabilities and capital at a specific point in time. It’s also called a statement of financial condition. An organization’s balance sheet gives an idea of how much they own and owe, as well as the amount invested by shareholders.

One look at the balance sheet told Arjun that the company wasn’t worth investing in.

3. Capital Gains Tax (CGT)

The capital gains tax is the amount of tax that is payable on the profit from the sale of a capital asset (either a property or an investment).

Before you sell off the old farmhouse, keep in mind the capital gains tax that you’ll have to pay.

4. Deflation

Deflation is the opposite of inflation; it’s the reduction in the supply of circulated money in any economy.

5. Earnings Per Share (EPS)

Earnings per share is the net income of a company, divided by its number of outstanding shares. EPS indicates a company’s profitability.

Mark’s team decided to join the company because of the company’s increasing earnings per share.

6. Financial Year / Fiscal Year

Financial or fiscal year refers to a period of 12 consecutive months or 52 consecutive weeks, after which financial reports are prepared. It may not match with a calendar year. In the U.S. it’s called a fiscal year and is also sometimes called a tax year.

The next fiscal year will begin in October 2017 and go until September 2018.

7. Golden Rule

The Golden Rule is a term in fiscal policy that basically means that over an economic cycle, the government should borrow to pay for investments that benefit future generations.

8. Half Year

The half-year convention is an assumption that newly acquired assets are in use halfway through the year, regardless of the actual length of time the assets have been in use.

We need to follow the half-year convention to calculate the company’s annual taxes.

9. Income Tax

Income tax is the tax levied by the government on the total income generated by individuals and companies.

10. Joint Account

A joint account is a bank account registered under the names of two or more individuals. All members can deposit and withdraw money from it.

11. Keynesian Economics

Keynesian economics refers to the various theories formulated by the British economist John Maynard Keynes during the Great Depression, which he published in his 1936 book “The General Theory of Employment, Interest, and Money.”

12. Liquid Asset

A liquid asset is cash or any asset that can be quickly converted to cash without loss in value.

He insisted that I need to have enough liquid assets to qualify for a home loan.

13. Macroeconomics and Microeconomics

Macroeconomics refers to the study of whole (aggregate) economies or economic systems, while microeconomics refers to the study of individual units, like a person or a company.

14. Net Asset Value (NAV)

The net asset value is the value of an entity’s assets, minus the value of its liabilities.

A mutual fund’s net asset value will tell you if your investment is worth it.

15. Oligopoly

An oligopoly is a name for a market that is dominated by a few sellers and therefore has less competition.

16. Pay As You Earn (PAYE)

PAYE is a tax payment method where your taxes are deducted from your salary itself, before you receive your salary.

I thought the PAYE system would cut down on my earnings, but it has actually made my life easier.

17. Quota

A quota is a share or a set number of things or people. In economics, quotas are usually limitations on imports or exports.

The new reform in the import quota is a great help for domestic suppliers.

18. Real Interest Rate

A real interest rate is the current rate of interest offered by a bank, minus the rate of inflation.

19. Shareholder

A shareholder is any person or company that owns shares of stock in a corporation.

James recently became a shareholder in a major corporation.

20. Tax Haven

Simply speaking, a tax haven is an area where taxes are imposed at a low rate (or not at all).

Jimmy wanted to know more about offshore accounts so I told him to research tax havens.

21. Unit Trust

A unit trust is an organization that pools money from small investors and invests it in shares and stocks under a trust deed.

If you’re a first-time investor, consider partnering with a unit trust.

22. Value-added Tax (VAT)

A value-added tax is a consumption tax on goods and services.

23. White Knight

A white knight is a person or company that “saves” a corporation from being taken over by a hostile company.

24. X-Efficiency

X-efficiency refers to the production of something at the minimum possible cost. It’s the degree of efficiency maintained by corporations when there’s a lack of competitive pressure.

25. Yield

Yield refers to the yearly income earned from an investment. It’s often expressed as a percentage.

What’s the minimum yield you expect from this investment?

26. Zombie Fund

A colloquial term for a closed fund, a zombie fund refers to a for-profit life insurance fund that has been closed to new business.

Resources for Improving Your Economics Vocabulary

Here are a few more ways you can improve your English economics vocabulary:

- Take an online course. There are some great options on sites such as Coursera, Open Culture and Alison.

- Check out our vocabulary lists on banking and accounting, or this list of business terms from The Guardian.

- Read business and economics newspapers and magazines such as The Economist.

- Watch authentic English videos on a language learning program like FluentU to learn vocabulary in a natural and engaging way. With interactive subtitles and a contextual dictionary, you can learn terms as they’re used in real-life scenarios and secure them in your memory.

There’s a very simple way you can make learning economics a daily habit with just 15 minutes per day. Spend the first 10 minutes speed learning at least 3 to 5 new concepts or words, and then use the last 5 minutes to review them by trying to make sentences or applying them to real-life situations.

Whenever you learn a new word or concept, try to use it soon in a conversation or simply practice it by role-playing with yourself or with a friend. Try doing this for 1 or 2 months at a continuous stretch, and soon enough, you’ll see amazing results that will motivate you to take your studies even further.

Even if you’re new to the field of economics, there’s no need to worry. A proper understanding of the basics can go a long way.

And if you dedicate even a short time to practicing every day, your English vocabulary will grow faster than you may think.

Above all, be confident and believe in yourself and your abilities!

Download: This blog post is available as a convenient and portable PDF that you can take anywhere. Click here to get a copy. (Download)

English Immersion from Your Device

I get it–learning English isn’t always a walk in the park. But it doesn’t have to be a boring, tedious, or hair-pulling experience either. In fact, making it fun is key to your success!

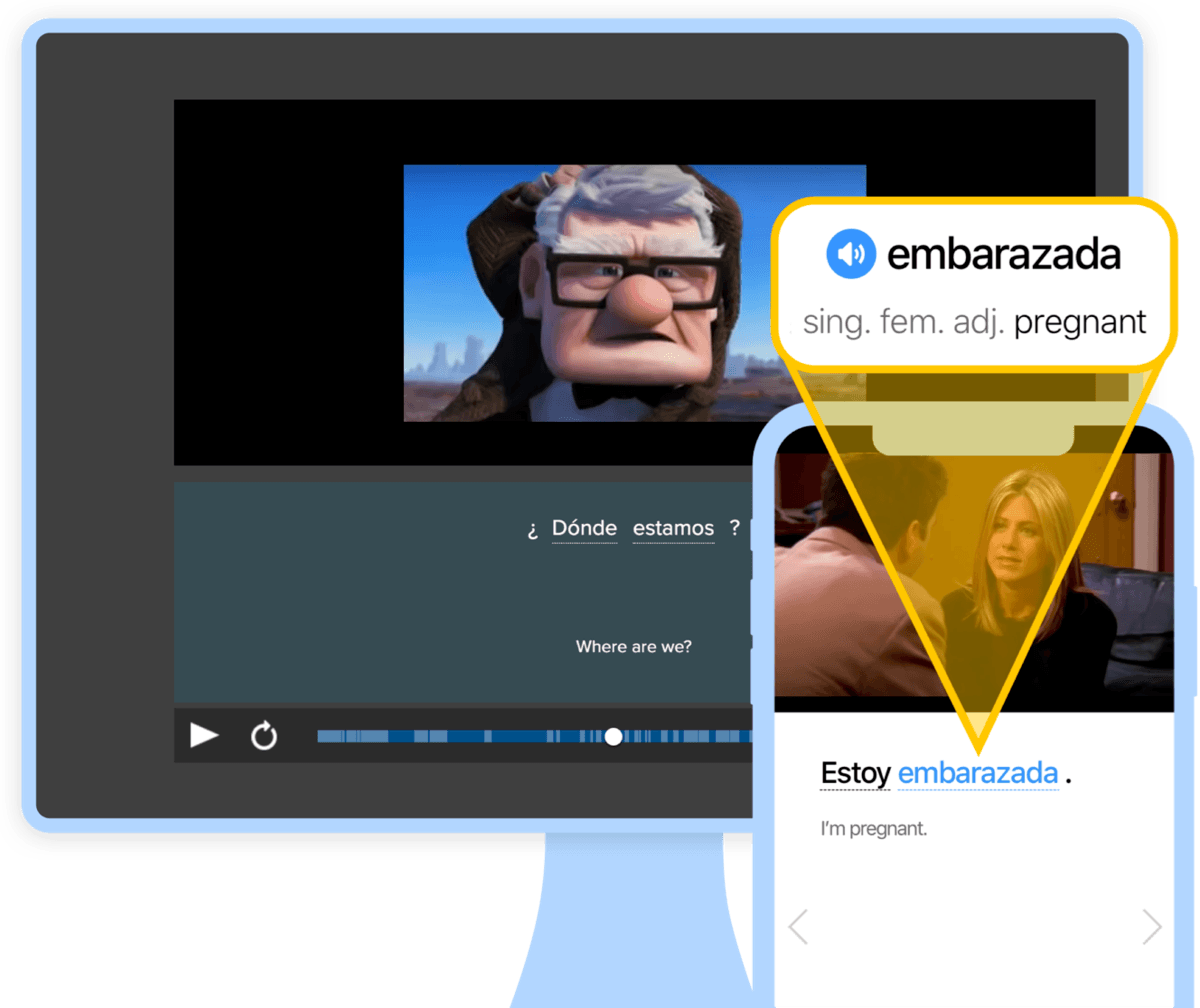

With FluentU, you can learn English naturally by turning any YouTube or Netflix video with subtitles into an interactive language lesson. I’m talking about language immersion from the convenience of your device.

Plus, you can import your favorite YouTube videos into your FluentU account to learn from them using the app or website. Or browse our curated library of videos handpicked for beginners and intermediate learners.

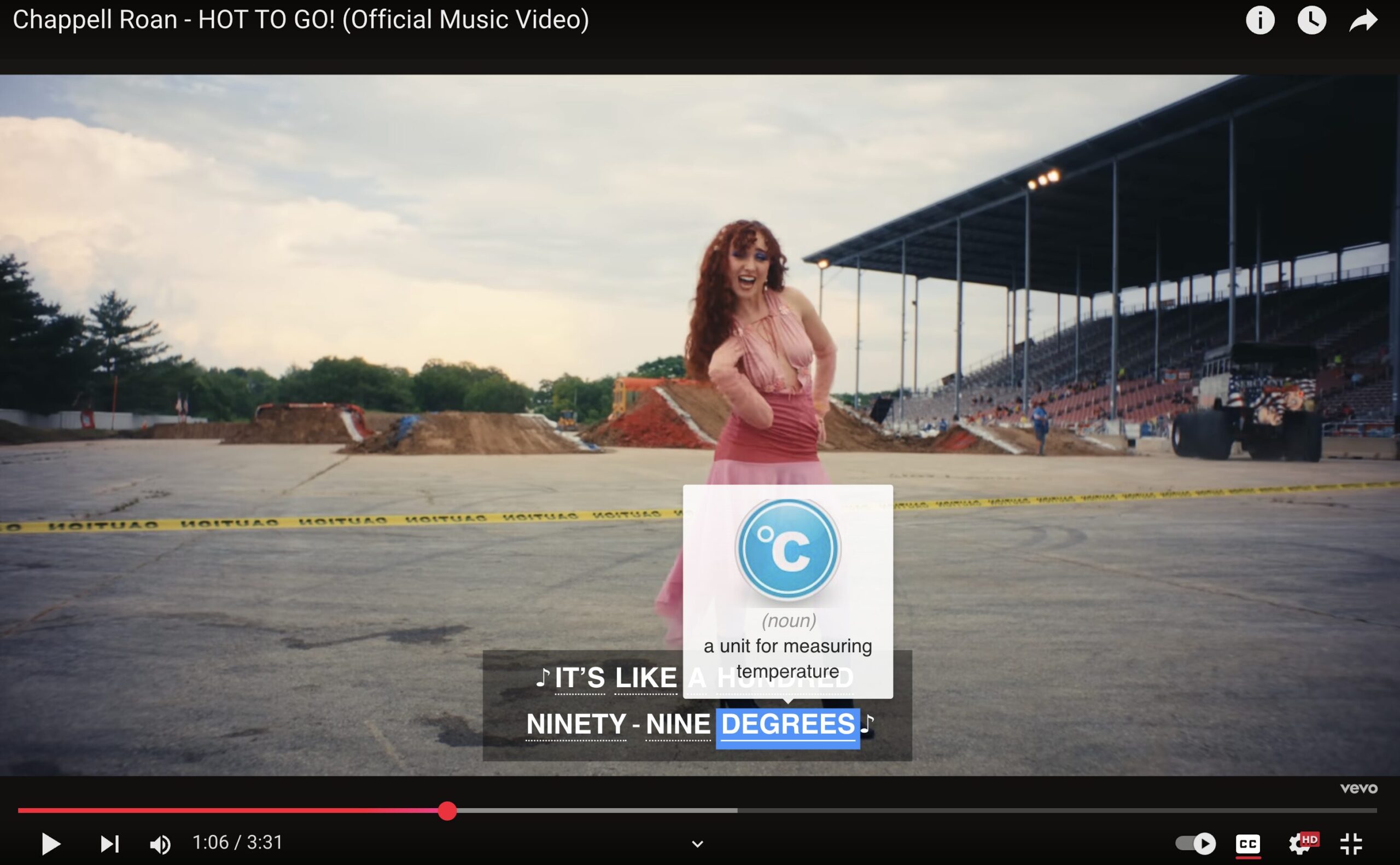

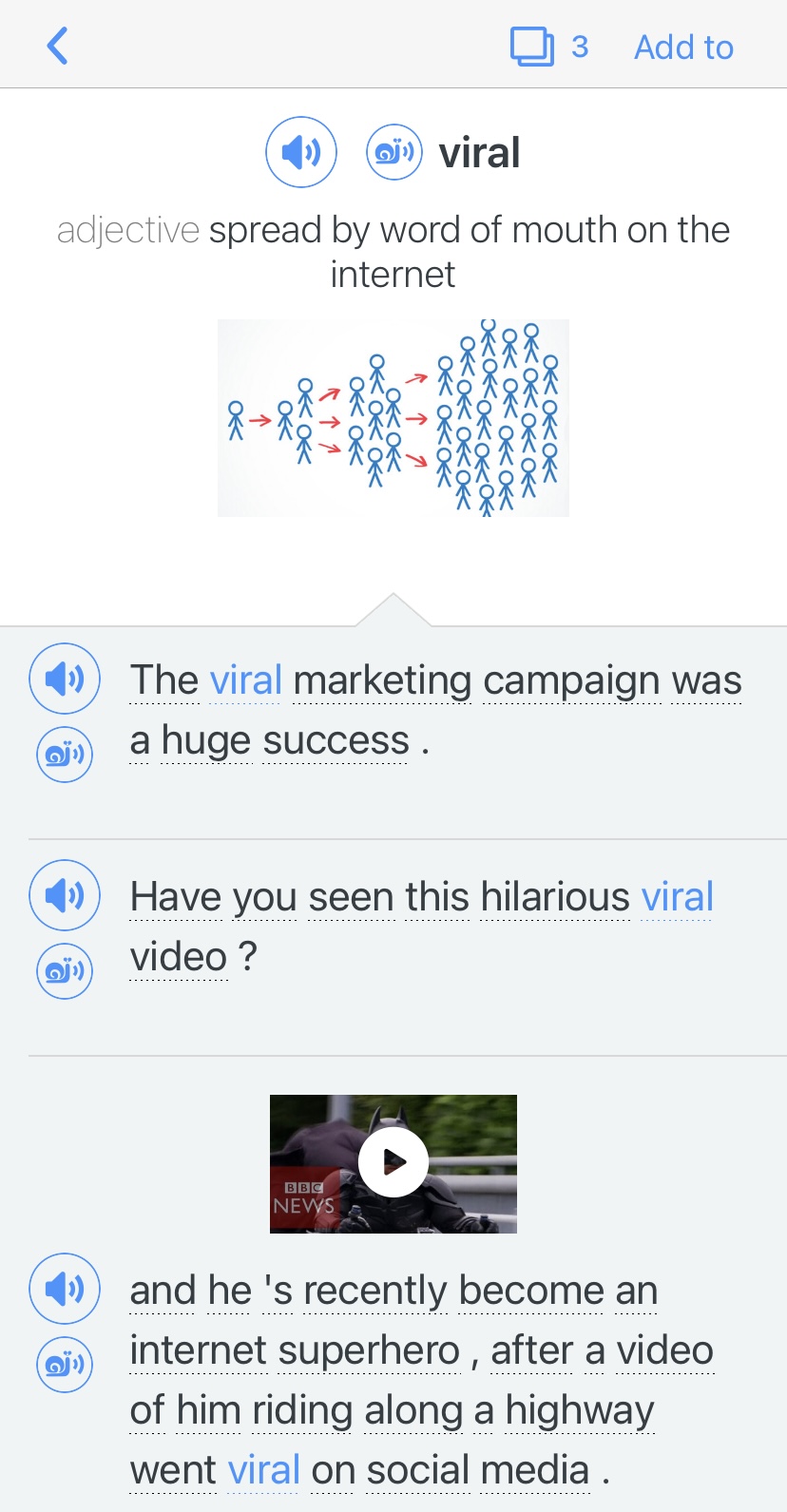

While you watch a video, FluentU’s interactive subtitles let you tap on any word for an instant definition, example sentences, images, and audio. No more pausing and searching for translations—everything you need is right there!

It's all built to help you learn how to use words in real contexts. For example, if I tap on the word "viral," this is what pops up:

Learn even faster with built-in quizzes that reinforce vocab from every video. FluentU tracks your progress, gives you extra practice with tricky words, and reminds you when it’s time to review—so your learning is always personalized and effective.

Try FluentU today on your computer or tablet, or download our app from the App Store or Google Play. Click here to take advantage of our current sale! (Expires at the end of this month.)